- Ministry of Options

- Posts

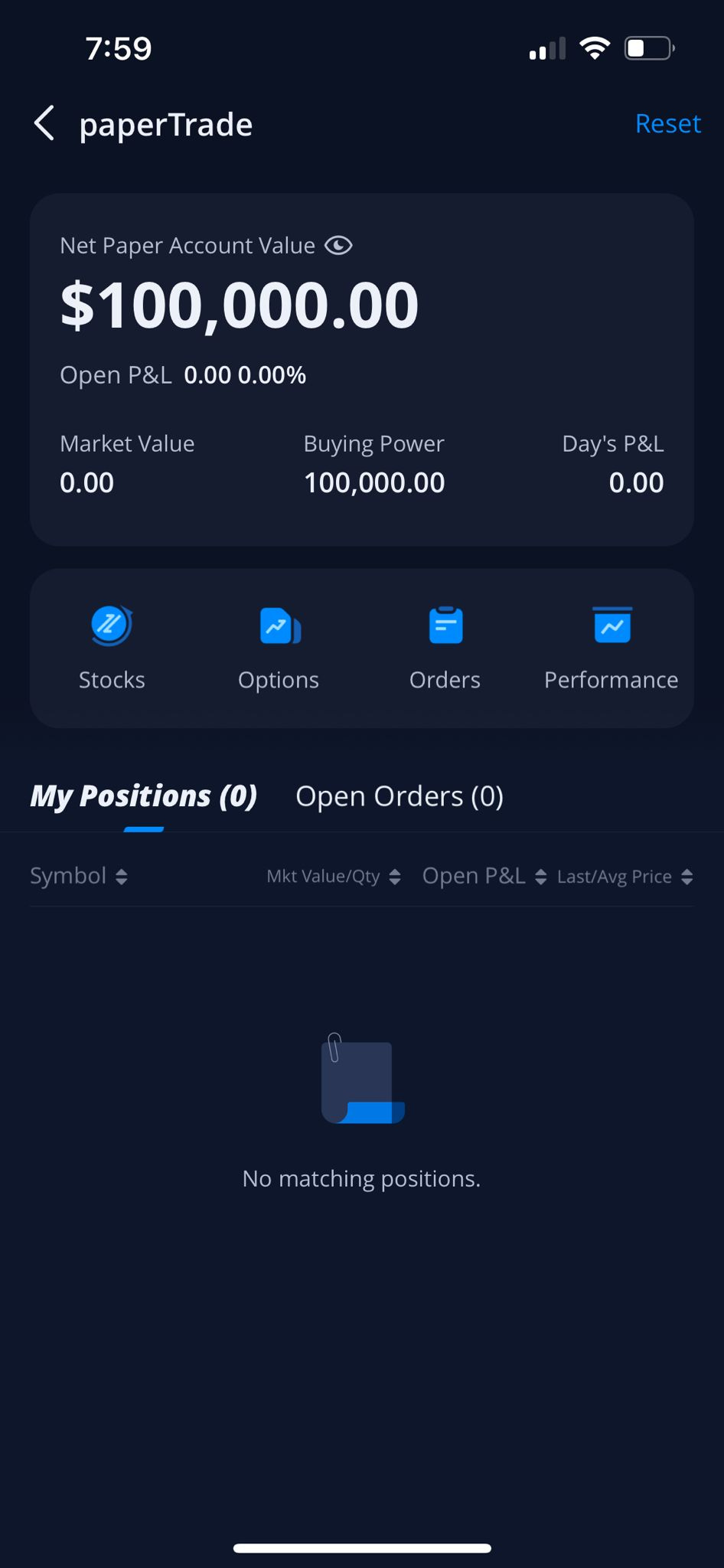

- Trading Account Challenge Day 1

Trading Account Challenge Day 1

22 July 2024

Started a new account challenge with 100k today.

Stock analysis:

Chart: Looked at NVDA pre-market today. Based on chart, on the 1day time frame, NVDA shows itself to be at a support level, just below 120. It sits just around the VWAP (blue line). However, the 5EMA (green) is below the 20EMA (yellow), indicating that NVDA has not yet crossed into the positive range for now. For a bigger portfolio, this may be the time to enter. With a smaller portfolio, may want to wait for NVDA to retrace further before entering.

Financials: NVIDIA's latest financial figures for fiscal 2024 show significant growth, particularly driven by its data center and AI-driven segments. Here are the highlights:

Revenue: NVIDIA reported $18.12 billion in revenue for the third quarter of fiscal 2024, a significant increase from $5.93 billion in the same quarter the previous year. For the first nine months of fiscal 2024, the revenue was $38.82 billion, compared to $20.92 billion for the same period in 2023 (NVIDIA Newsroom) (NVIDIA Investor Relations).

Net Income: The net income for the third quarter was $9.24 billion, up from $680 million in the third quarter of fiscal 2023. For the first nine months, net income was $17.48 billion, a substantial rise from $2.95 billion the previous year (NVIDIA Newsroom) (NVIDIA Investor Relations).

Earnings Per Share (EPS): Basic earnings per share for the third quarter were $3.75, and diluted earnings per share were $3.71. This compares to $0.27 for both basic and diluted EPS in the third quarter of fiscal 2023 (NVIDIA Newsroom) (NVIDIA Investor Relations).

Operating Income: Operating income for the third quarter was $10.42 billion, up from $601 million a year earlier. For the first nine months, operating income was $19.36 billion, up from $2.97 billion (NVIDIA Newsroom) (NVIDIA Investor Relations).

Data Center Growth: The data center segment continued to show robust performance, contributing significantly to the revenue boost, especially with increased demand for AI and machine learning capabilities (NVIDIA Investor Relations).

These figures highlight NVIDIA's strong performance, especially in AI and data center technologies, positioning it well for continued growth in these high-demand areas. For more detailed financials and insights, you can visit NVIDIA's investor relations page (NVIDIA Newsroom) (NVIDIA Investor Relations).

Fair Value: Analysts are split between the fair value of NVDA. Some claim that NVDA is now over-valued, with fair value at around $43, while others claim it should be around $130. See Simplywallst.

Thought: For now, investors seem to have “left” NVDA for other stocks. It may be less likely that NVDA will see a parabolic shoot. That said, NVDA shows great potential based on the company performance and chart. May be considering a LEAP call contract.